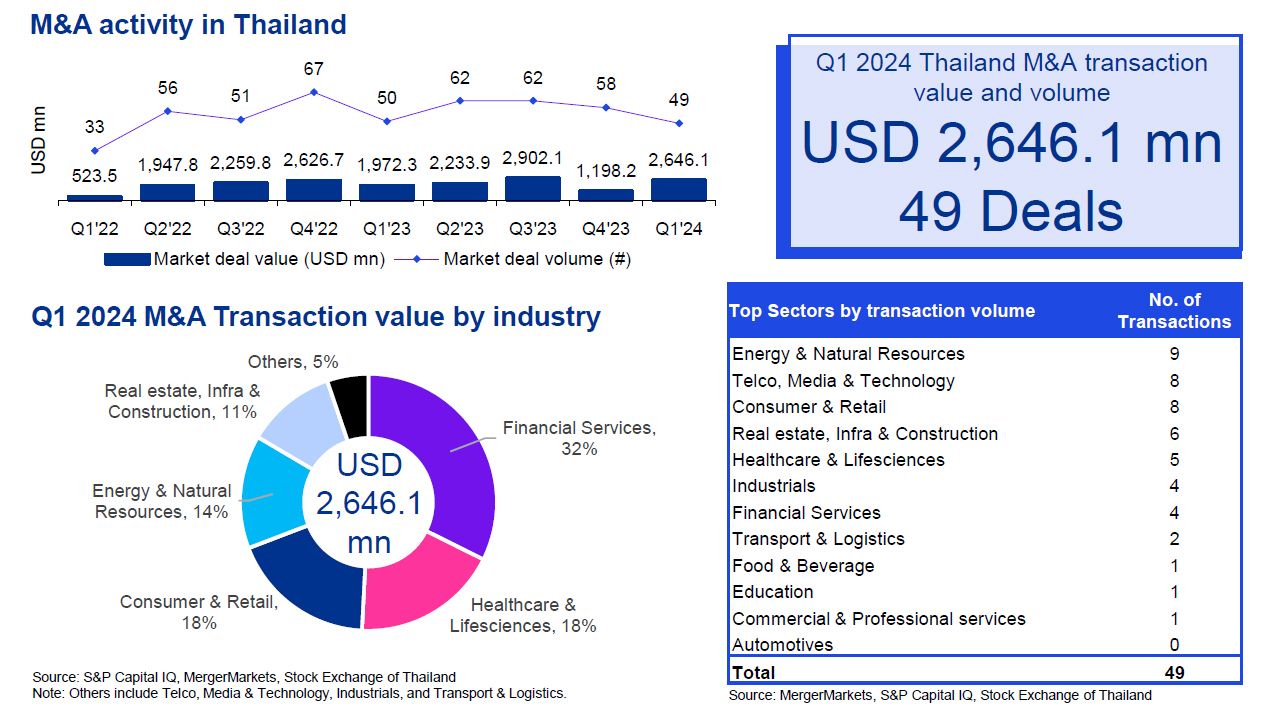

M&A activity in Q1 2024 saw significant growth at 121% compared with the previous quarter, as the total transaction value more than doubled to USD 2.6 billion versus USD 1.2 billion in Q4 2023. However, deal volume reduced to 49 deals versus 58 in Q4 2023. Of the 49 deals this quarter 38 were domestic or inbound and accounted for 43% of deal value, while 11 outbound deals represented the remaining 57% of deal value. The Financial Services, Healthcare & Life Sciences, and Consumer & Retail sectors accounted for 69% of total deal value. The biggest deal of the quarter was SCB’s announced USD 854 million acquisition of Home Credit Vietnam Finance Co., Ltd., as part of SCB’s ASEAN expansion strategy. A notable transaction was PTT’s life sciences division’s (Innobic) divestment of Europe-based Alvogen Malta valued at USD 300 million in order for Innobic to focus on the Asia-Pacific business.

Recent developments indicate varied sentiments toward the Thai economy. The World Bank has downgraded its 2024 GDP forecast to 2.8% from 3.2%, following the 5-month delay in the approval of the 2024 fiscal budget, and weaker export markets. Macroeconomic concerns persist regarding the sustainability of private debt levels and the efficacy of the planned fiscal expenditure to propel the economy, as the government allocates approximately 14% of the approved THB 3.5 trillion budget to the digital wallet scheme. In comparison, the private sector remains bullish on the economy's tourism-backed recovery, and local conglomerates are preparing for further expansion throughout the year. This optimism is further fueled by over 70 investment privileges granted by the BOI in the first quarter to foreign manufacturers and service providers in the electric vehicle supply chain.

Certainty regarding the maintenance of current policy rates by the Bank of Thailand (BoT) in order to preserve macro-financial stability paired with institutional actions taken by the BoT and commercial banks to alleviate pressure on private debt may provide a basis for a more robust deal landscape going into the next quarter. Importantly, distressed situations and strategic acquisitions will remain a major theme, as more SMEs and private equity funds may look to exit constrained, highly leveraged positions, and conglomerates search for cheaper strategic opportunities to grow.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia